External Debt as a Whip

siyaset

13-12-2018, 10:22

624

One of the most discussed issues in media and social network is external debt of countries. Let’s first take a look, what is external debt. External debt is the aggregate debt owed to foreign lenders – such as banks, countries, organizations and etc. This debt might be borrowed by the country, companies and individuals. External debt of Azerbaijan is not that much. Of course, 9.6 Billion US Dollars is quite large amount if we take it individually. But it needs to be considered that this number is only accounted for 22% of GDP. But, the question is, is the lower rates of external debt positive indicator? Does it mean that if debt is less, everything is okay?

One of the most discussed issues in media and social network is external debt of countries. Let’s first take a look, what is external debt. External debt is the aggregate debt owed to foreign lenders – such as banks, countries, organizations and etc. This debt might be borrowed by the country, companies and individuals. External debt of Azerbaijan is not that much. Of course, 9.6 Billion US Dollars is quite large amount if we take it individually. But it needs to be considered that this number is only accounted for 22% of GDP. But, the question is, is the lower rates of external debt positive indicator? Does it mean that if debt is less, everything is okay? To look at the issue from narrow perspective it might be thought that having debt is not good thing at all. But assume that I borrowed 1M US Dollars and started a business. Whose welfare is better – the one has no debt but no business or mine?

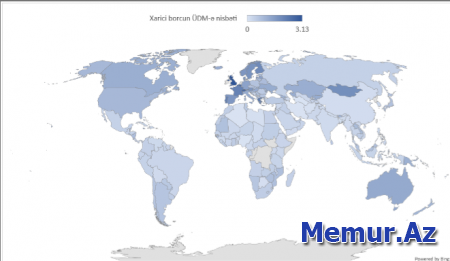

Let’s take a look at the map below. The map shows the ratio of external debt to GDP of the countries. Darker shades represents relatively higher ratios. What is interesting in general? The countries having the highest external debt ratio are mainly in Europe and Northern America, in other words – Developed countries.

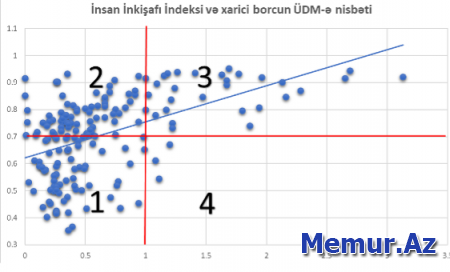

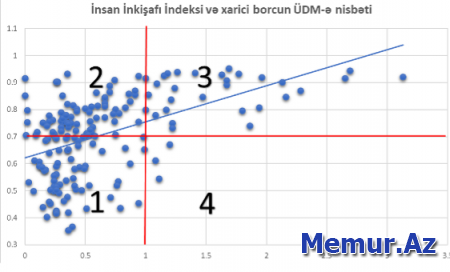

To make it clearer it is better to look at the graph below. Human Development Index (HDI) is represented through vertical line, while external debt ratio to GDP is represented in horizontal line. Prior to talking about the graph let mention that HDI is a summary measure of average achievement in key dimensions of human development: a long and healthy life, being knowledgeable and have a decent standard of living. The HDI is the geometric mean of normalized indices for each of the three dimensions. Value is varied between 0 and 1, the closer to 1, the better considered it is.

Calculations show that, ratio of external debt to GDP is positively correlated with HDI with 50% significance. Apparently, graph is divided to 4 parts by red lines:

Calculations show that, ratio of external debt to GDP is positively correlated with HDI with 50% significance. Apparently, graph is divided to 4 parts by red lines: 1- HDI lower than 0.7, external debt less than GDP,

2- HDI higher than 0.7, external debt less than GDP,

3- HDI higher than 0.7, external debt more than GDP.

Countries in first group are mainly poor and underdeveloped countries. Their external debt is even close to zero.

The second group where Azerbaijan belongs to are those countries with mid and high revenue emerging and developed countries with lower rates of external debt. Most of this countries (oil countries) make reserve by the revenues coming from national resources and stay away from being owed to others.

The third group is also countries with mid and high income emerging and developed countries but with higher rates of external debt. The density in this part explains that in order to be developed and to get high revenue having high external debt doesn’t make any obstacles.

The fourth group countries are poor and underdeveloped countries with high external debt. There are only a few this type of countries in the world. So as a result, the countries with high external debt are those who developed the most.

Another issue regarding to the external debt is that it creates dependence both political and economic wise. Once the country has large amount of debt, the opposite part take advantage of it to increase pressure on the counterpart. For example, now none of the countries has that power against Azerbaijan. Because, in fact, the aggregate reserves in Central Bank and State Oil Foundation of Azerbaijan Republic is 4 times more than external debt.

Having low rates of debt of course is not bad, but wisely controlled debt might change situation from the whip slapped in the back of the country to the whip as a powerful arm in the hand.

Zal Alizada

2018 - Baku